44+ rental property mortgage interest deduction

Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

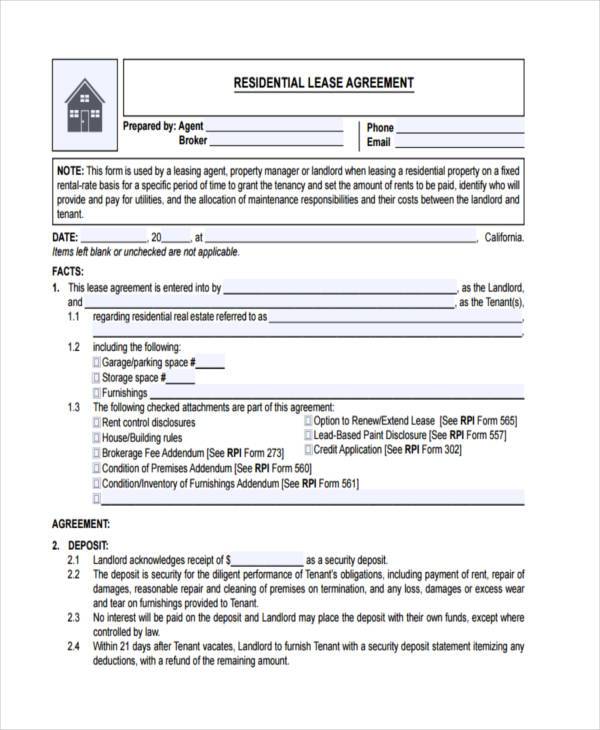

44 Agreement Form Samples Word Pdf

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web You get to deduct your rental expenses from any income you earn including items such as mortgage interest property taxes insurance repair and maintenance.

Ad Shortening your term could save you money over the life of your loan. Web You can claim a deduction for mortgage interest you pay on a home you occupy and on a rental property. During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu.

Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for. Web Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal.

Also you can deduct the points. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. If you take out a 2000000 mortgage against a.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. However higher limitations 1 million 500000 if married.

Rental income 11000 Finance costs 8000 x 75 -. Web The rental property mortgage interest deduction offers significant tax benefits. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web Her mortgage interest is 8000 per year. Homeowners who bought houses before December 16. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Heres how it works using an example property purchased for 325000 with a. Received 40000 from rental. Salary before tax 25000 Property income calculation.

Interest On Buy To Let Mortgages Eoacc Uk

Free 44 Agreement Forms In Pdf

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Top Tax Deductions For Second Home Owners

Buy To Let Mortgage Interest Tax Relief Explained Which

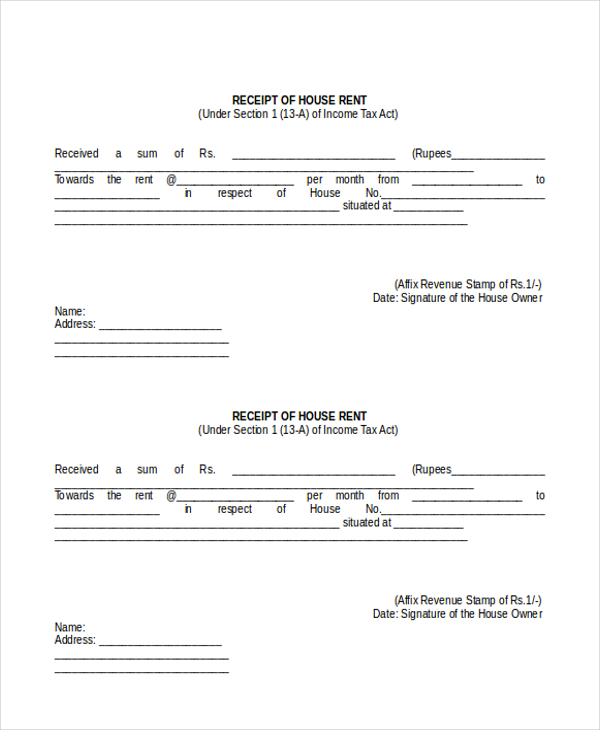

Free 9 Sample Rental Receipt Forms In Pdf Ms Word Excel

Vacation Home Rentals And The Tcja Journal Of Accountancy

Bonus Depreciation Definition Examples Characteristics

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

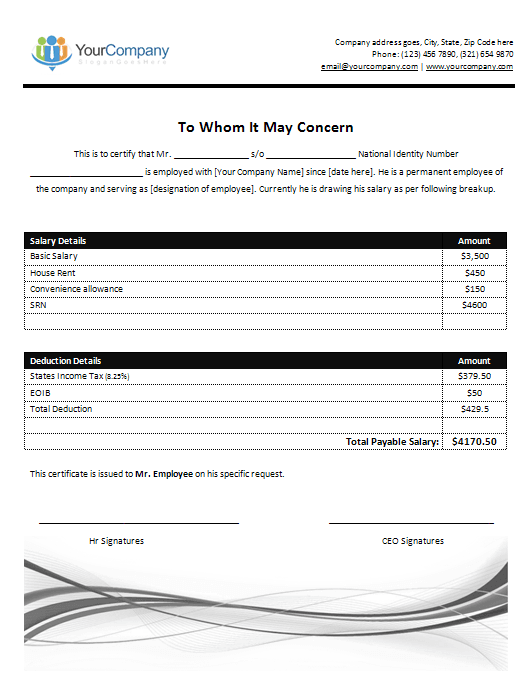

Ms Word Salary Certificate

Rental Property Tax Deductions A Comprehensive Guide Credible

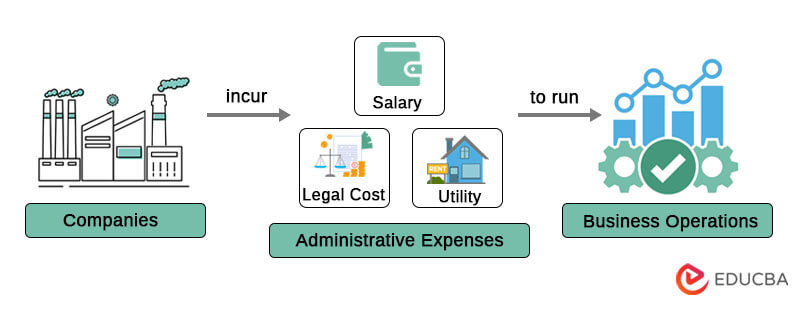

Administrative Expenses Meaning List Real Company Examples

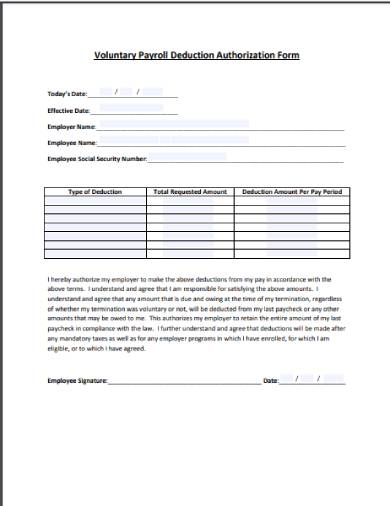

Free 6 Voluntary Deduction Agreement Samples In Pdf

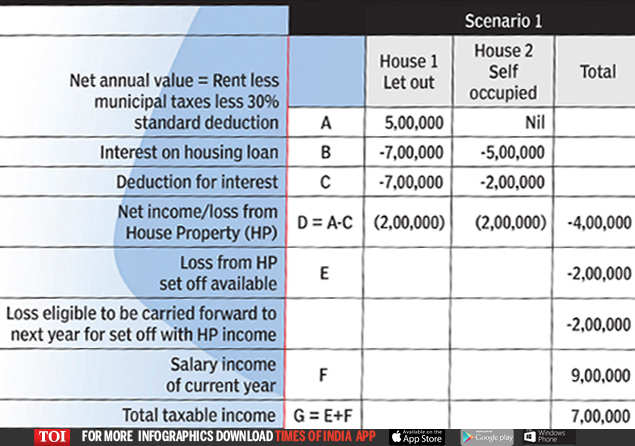

House Rent How To Castle For A Cut Times Of India

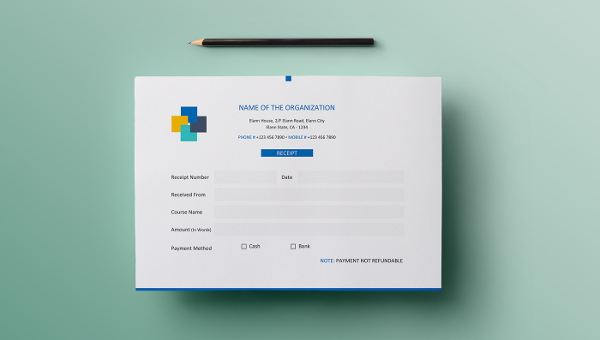

Free 44 Receipt Forms In Pdf

Understanding Tax Deductions On Your Rental Property

Can You Claim Rental Mortgage Interest As An Itemized Deduction